What is Multilateral Netting? - Coupa

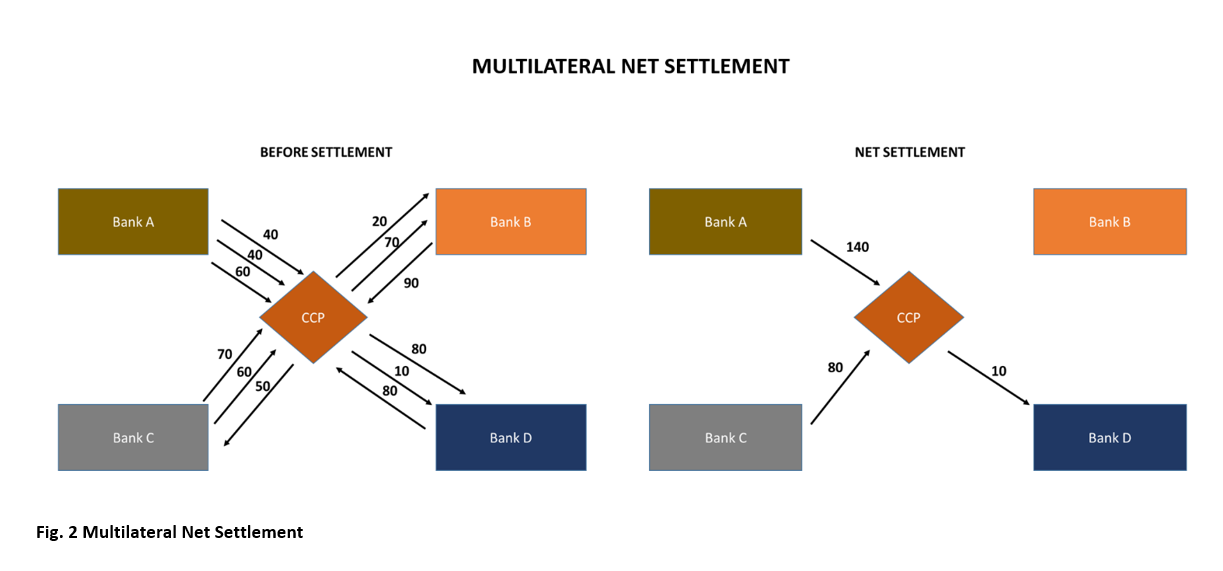

Multilateral Netting is the off-setting of payables against receivables between multiple group companies.

What is Multilateral Netting? - Coupa

Working Capital Management, Reduce Financial Risk

Multilateral netting: Comparing Bilateral and Multilateral Netting Systems - FasterCapital

Treasury Management, Cash & Liquidity Management

Treasury

Christa Fritz on LinkedIn: #coupaproud #treasurymanagement #afp2022

The Role of Netting in Cash Management - Coupa

Coupa Review with Pricing, Comparisons, and FAQs

Intercompany Netting - GTreasury

Treasury Management, Cash & Liquidity Management

Bilateral Netting - What Is It, Examples, Vs Multilateral Netting

Coprocess's Competitors, Revenue, Number of Employees, Funding, Acquisitions & News - Owler Company Profile

What is Multilateral Netting and How Does It Work?

The Role of Netting in Cash Management - Coupa

Working Capital Management, Reduce Financial Risk